Dutch Bank and SWIFT Codes Key to International Transfers

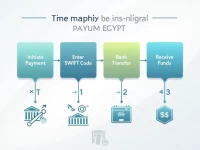

This article explains how to use the SWIFT code for NEDERLANDSCHE BANK (DE) N.V. for international remittances, highlighting the importance of the SWIFT code and providing guidance on its correct usage. It includes specific bank information and remittance recommendations, while also suggesting the use of the Xe platform for better exchange rates and professional support.